colorado estate tax rate

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim this. But when you add any local taxes they can get up closer to 8.

Does Your State Have An Individual Alternative Minimum Tax Amt

Without planning your best intents to properly distribute your estate might not be enough.

. County Tax Rate 0013980. The list is sorted by median property tax in dollars by default. Property taxes in Colorado are definitely on the low end.

Payments and Due Dates. Use Schedule E on the Fiduciary Income Tax Return DR 0105 to make the apportionment. The tax rate is often expressed as a mill levy.

Colorado has no estate tax for decedents whose date of death is on or after January 1 2005. Estate tax can be very complicated. The due date for the second half of your property taxes is June 15 2022.

The loan is logged as a lien against the participants property that does not have to be remitted until the participant no longer qualifies to defer their property taxes. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

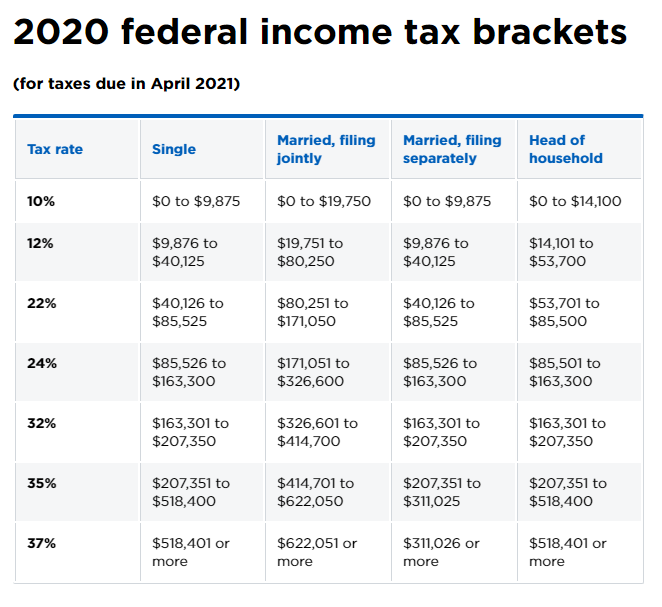

The state income tax rate is. The following are the federal estate tax exemptions for 2022. The statewide sales tax in Colorado is just 29 but with local sales taxes the statewide average is 772.

Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets. They will average around half of 1 of assessed value. Property Tax Relief Package Would Save Average Colorado Homeowner 274.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Revenue from Property Tax Total Assessed Value. City Tax Rate 0008752.

The current percentage for residential property is 715. There are jurisdictions that collect local income taxes. Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security interests therein.

Its very likely that you wont have to pay them. The average effective property tax rate in Adams County is 068. Federal legislative changes reduced the state death.

However if the decedent owned any sort of real property the estate must apply for normal probate. The due date for the first half of your property taxes is February 28 2022. A state inheritance tax was enacted in Colorado in 1927.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. If not click the link. Property Tax Information Search for real and personal property tax records find out when property tax payments are due accepted payment methods tax lien sales and property tax rebate programs offered by the City and County of Denver.

Median property tax is 143700. Depending on local municipalities the total tax rate can be as high as 112. Federal Estate Tax Exemptions For 2022.

Colorado tax forms are sourced from the Colorado income tax forms page and are updated on a yearly basis. Property taxes in Colorado are among the lowest in the country with an average effective rate of just 040. Colorado sales tax details The Colorado CO state sales tax rate is currently 29.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. Oak Street Fort Collins CO 80521 Map of Facilities 970 498-7000 Contact Us Our Guiding Principles. Federal legislative changes reduced the state death.

Colorado has a 455 percent corporate income tax rate. That translates to a median tax bill of about 1647 for county homeowners. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000.

Sales tax rate. State wide sales tax in Colorado is limited to 29. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to the modified federal taxable income.

In most cases only estates with a very high value are subject to Colorado estate taxes. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Requirements for Eligibility Applicant must be a senior who is 65 years or older or a person called into military service pursuant to CRS 39-35-101 18 on January 1 of.

Ad Properly drafted estate plan does more than merely specifying what happens to your assets. What is the tax rate for Colorado. Get information on property taxes including paying property taxes and property tax relief programs.

But there are some exceptions to this. The 2022 state personal income tax brackets are updated from the Colorado and Tax Foundation data. Colorado Property Taxes by County.

Property Owner Address Change. The specifics of the estate may dramatically change your tax bill. This interactive table ranks Colorados counties by median property tax in dollars percentage of home value and percentage of median income.

Marijuana is legal in Colorado and the tax on marijuana purchases is 15. You should be redirected automatically to target URL. The state of Colorado requires you to pay taxes if youre a resident or nonresident that receives income from a Colorado source.

Planning an estate in. Colorado also has a 290 percent state sales tax rate a max local sales tax rate of 830 percent and an average combined state and local sales tax rate of 777 percent. Inheritance tax is a tax paid by a beneficiary after receiving inheritance.

On June 29 2022 the Colorado Department of Revenue Division of Taxation adopted a temporary emergency rule to comply with a state or federal law and the need to set forth the manner in which the prearranged ride fees established in Senate Bill 21-260 which take effect on July 1 2022 are collected May 20 2022. The fifth most populous county in Colorado Adams County has the third highest property tax rate in the state. Colorado is ranked number thirty out of the fifty states in order of the average amount of property taxes collected.

Colorado imposes a sales tax rate of 290 percent while localities charge. School District Tax Rate. If you are paying your property taxes in full the due date is May 2 2022 due to the statutory due date of April 30 falling on a Saturday.

May increase with cost of living adjustments. Colorados tax system ranks 20th overall on our 2022 State. Make sure you have engaged an attorney or CPA to limit any tax that you have to pay.

Or 13980 mills. Is there personal property tax in Colorado. Counties in Colorado collect an average of 06 of a propertys assesed fair market value as property tax per year.

What is the property tax rate in Denver. A state inheritance tax was enacted in Colorado in 1927. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

All of the tax rates of the various taxing authorities providing services in your tax area are added together to form the total tax rate.

Colorado S Low Property Taxes Colorado Fiscal Institute

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Individual Income Tax Colorado General Assembly

Tax Rates Stranger Tallman Lautz Accounting Grand Junction Colorado

State Corporate Income Tax Rates And Brackets Tax Foundation

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Property Tax Calculator Smartasset

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Colorado S Low Property Taxes Colorado Fiscal Institute

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Don T Die In Nebraska How The County Inheritance Tax Works

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die